when are property taxes due in will county illinois

Then payments are allocated to these taxing authorities based on a predetermined payment. The mailing of the bills is dependent on the completion of data by other local.

2nd Installment Of Real Estate Taxes Due Will County Illinois Home

Subsequent taxes will only be accepted in office.

. Will County collects on average 205 of a propertys assessed fair market. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on. Odds are growing that the due date on 16 billion in Cook County property tax bills will be Dec.

In this situation the local municipality can eventually take over ownership of the property due to unpaid taxes. Most often taxing entities tax levies are combined under a single notice from the county. Pay 2021 Taxes payable in 2022 View 2021 Taxes.

Now rampant inflation is giving local taxing bodies the power to raise rates by 5. In most counties property taxes are paid in two installments usually June 1 and September 1. 1 2023 with a taxpayer savings of 70 million.

Cook County WLS -- The second installment of Cook County property taxes are usually due by August but those bills have not even been sent out to taxpayers yet. 2019 payable 2020 tax bills are. Having said all that you should check with the tax collectors office where your.

Shutterstock WILL COUNTY IL Due to the. Are Illinois property taxes extended. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000.

The median property tax in Will County Illinois is 4921 per year for a home worth the median value of 240500. 173 of home value. Tax amount varies by county.

Illinois was home to the nations second-highest property taxes in 2021. Chicago Street Joliet IL 60432. The state of Illinois is providing a property tax rebate in an amount equal to the lesser of the property tax credit you could qualify for 2020 property taxes payable in 2021 or 30000.

If you have a mortgage your lender will likely pay your property taxes for you and escrow the. Will County Treasurer Tim Brophy said the board should establish June 3 Aug. Has yet to be determined.

Tax Year 2021 Second Installment Property Tax Due Date. For now the September 1 deadline for the second installment of property taxes will remain unchanged. 3 as the due dates for 2021.

Bearing this in mind you could expect Will Countys property tax rates to be low and Illinois to be a state with low property tax. Instead of affordable taxation though Will County homeowners. DeKalb County Government 200 North Main Street Sycamore Illinois 60178.

In Will County property taxes are due on June 1st and September 1st of each year. 2 nd Installment due September 1 2022 with the interest to begin accruing September 2 2022 at 15 per month post-mark accepted. Welcome to Property Taxes and Fees.

Other Ways to Pay.

Puzzled By Property Taxes Improving Transparency And Fairness In Illinois Assessment System Illinois Policy

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Counties With The Cheapest Property Taxes In Illinois Neighborhood Loans

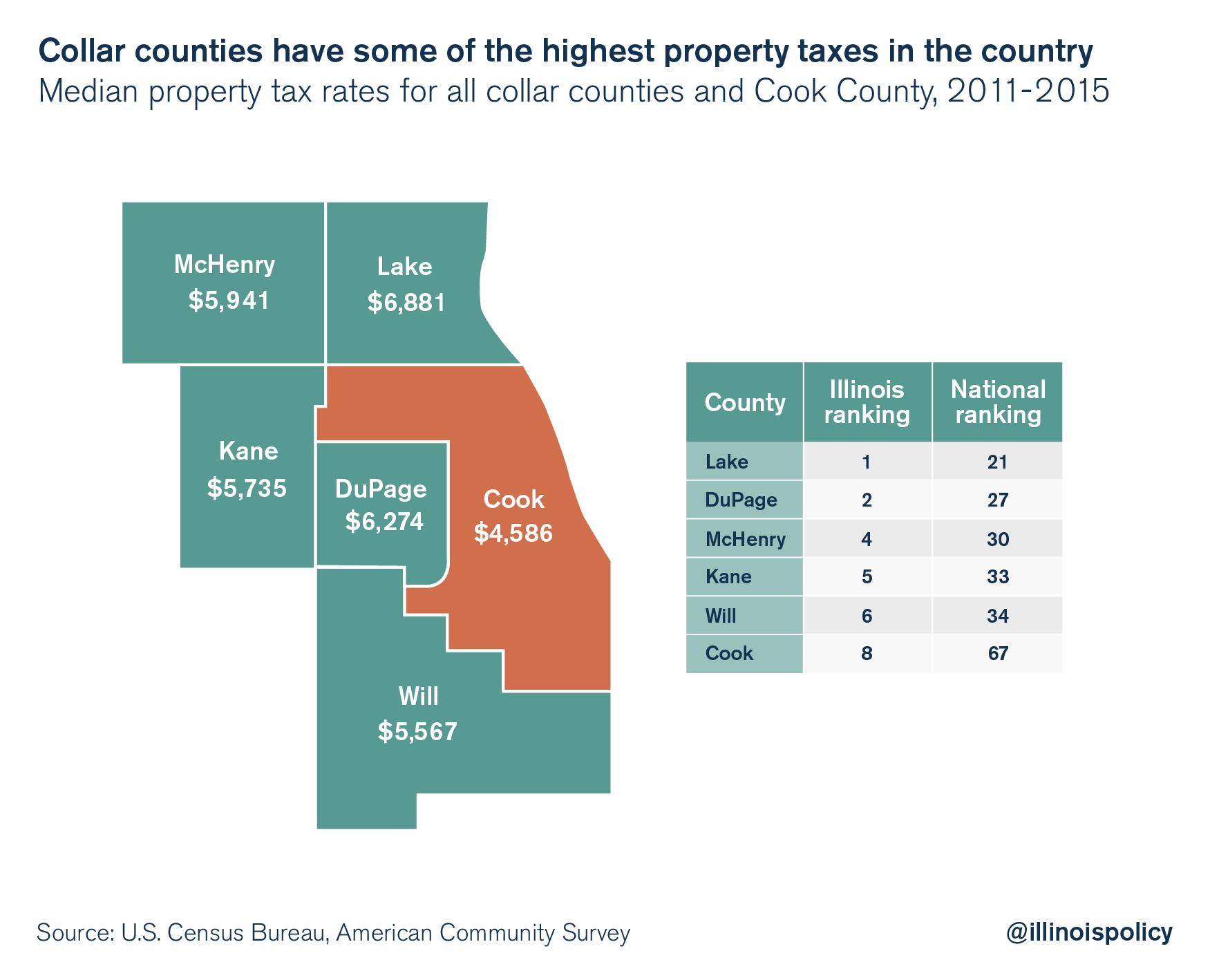

Homeowners In Collar Counties Pay Highest Property Taxes In Illinois

Analysis Property Taxes Rise In Chicago But Still Lower Than In Plainfield Bolingbrook Will County Gazette

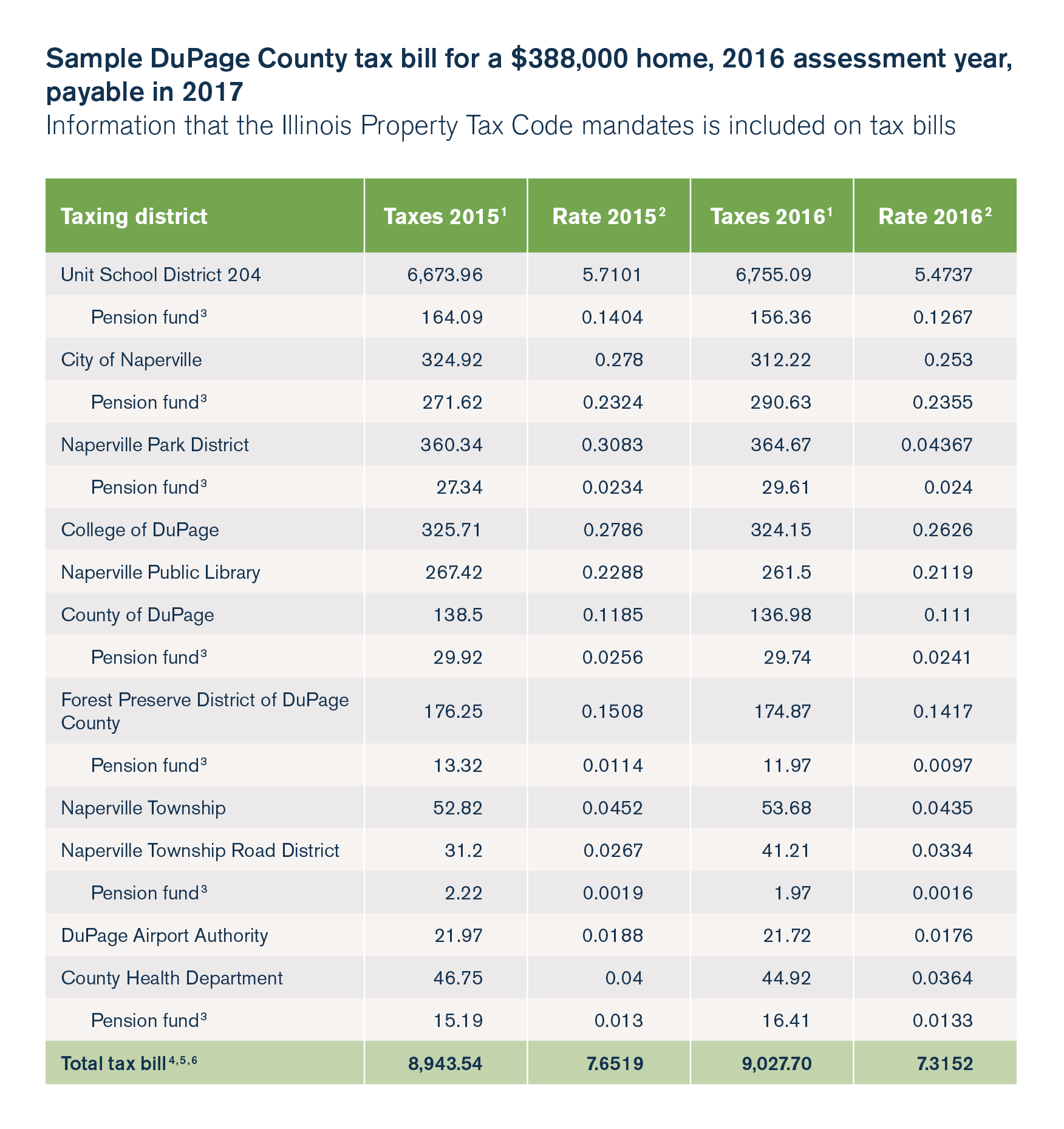

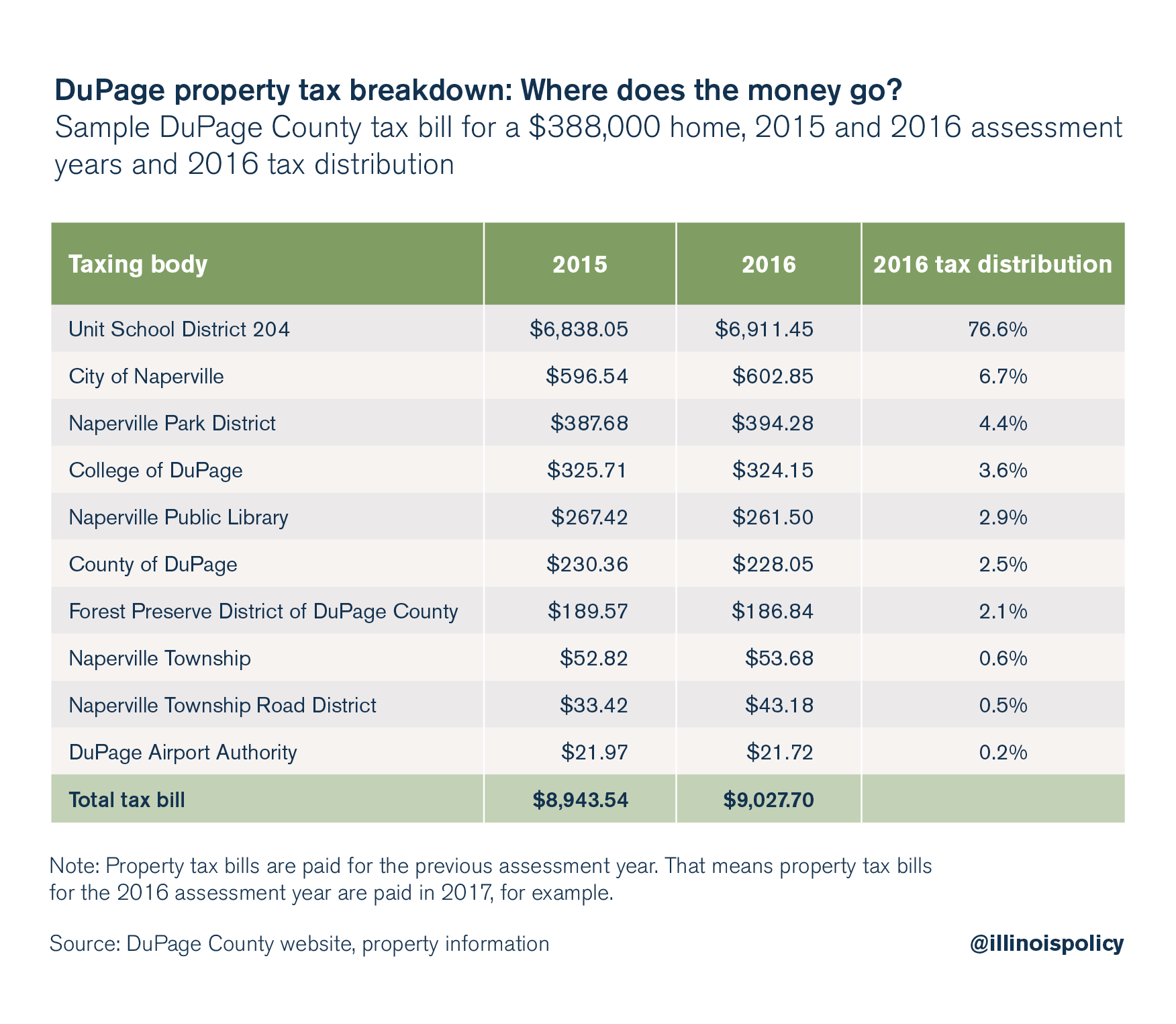

Dupage County Homeowners Where Do Your Property Taxes Go

Retirees Need To Take Action For Latest Property Tax Rebate Npr Illinois

Property Tax Burden In The Chicago Region Cmap

Reboot Illinois Which Illinois Counties Have The Highest Average Home Prices And Property Taxes Property Tax County House Prices

2022 Property Tax Notifications Arriving Soon Douglas County

Property Tax Burden In The Chicago Region Cmap

Counties With The Cheapest Property Taxes In Illinois Neighborhood Loans

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Will County Board Votes To Allow Residents A 60 Day Delay For Half Of Property Tax Bill Chicago Tribune

Important Tax Due Dates Lee County Il